The best way to stay on top of your FICO® Score and better understand your financial possibilities is to educate yourself. Fair Isaac provides a wealth of information regarding FICO® Scores as well as how to stay on top of your credit. Use the links below for more FICO® Score Credit Education.

| What FICO® Scores in this range mean | |||

|

Your score is well below the average score of U. S.consumers and demonstrates to lenders that you are a risky borrower. | ||

|

Your score is below the average score of U. S.consumers, though many lenders will approve loans with this score. | ||

|

Your score is near or slightly above the average of U. S. consumers and most lenders consider this a good score. | ||

|

Your score is above the average of U. S. consumers and demonstrates to lenders that you are a very dependable borrower. | ||

|

Your score is well above the average score of U. S. consumers and clearly demonstrates to lenders that you are an exceptional borrower. | ||

| Click Here for Frequently Asked Questions about FICO® Scores | |||

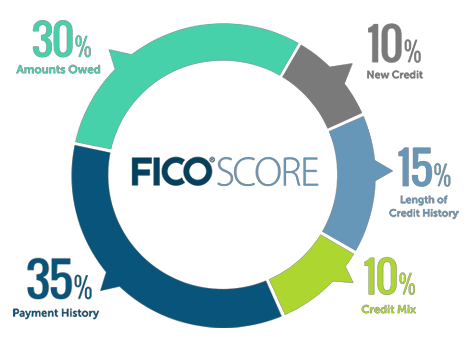

What's in FICO® Scores: The 5 Key Ingredients

FICO® Scores take into consideration five main categories of information in a credit report. The chart below shows the relative importance of each category to FICO® Scores.